The Chancellor appeared to take business by surprise by announcing moves for a new living wage of £9 an hour by 2020.

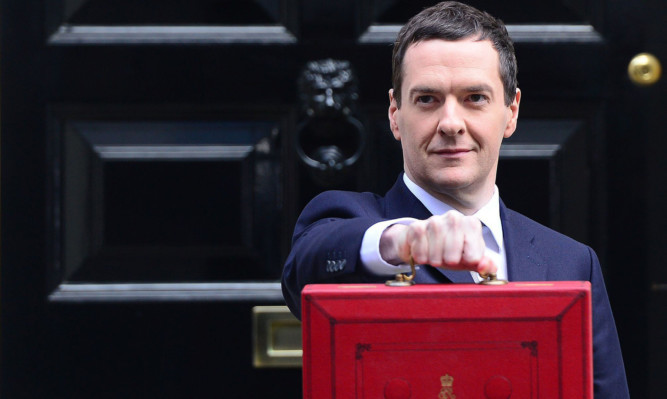

George Osborne said at the end of his Budget speech that “Britain deserves a pay rise”, as he unveiled a new compulsory living wage, set well above the national minimum wage.

Work and Pensions Secretary Iain Duncan Smith shouted out “fantastic” as Mr Osborne told MPs: “Working people aged 25 and over will receive it. It will start next April, at the rate of £7.20.

“The Low Pay Commission will recommend future rises that achieve the Government’s objective of reaching 60% of median earnings by 2020.

“That is the minimum level of pay recommended in the report to the Resolution Foundation by Sir George Bain – chair of the Low Pay Commission.

“Let me address the impact on business and employment. The OBR today say that the new national living wage will have, in their words, only a “fractional” effect on jobs.

“The OBR have assessed the economic conditions of the country, and all the policies in the Budget. They say that by 2020 there will be 60,000 fewer jobs as a result of the national living wage but almost one million more in total.”

The announcement follows a report by KPMG earlier this week which said that paying the living wage rather than the statutory minimum would only cost 1.3% of the national wage bill and bring in £4.5 billion in taxes and reduced benefit payments.

KPMG said it had calculated for the first time the impact of adopting the current higher rate of £7.85 an hour (£9.15 in London), compared with the adult national minimum wage of £6.50.

The professional services firm said companies that adopted the living wage had reported “clear benefits” to their businesses.

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe