The high street is rarely out of the news. We’re forever hearing it’s beleaguered and on its knees.

Some household names are struggling and may not survive. One former retail giant, BHS, could disappear altogether. Others, though, are breezing through a still tough economic climate.

While Sir Philip Green is contemplating selling BHS, H&M announced last week it is planning a global expansion, with plans to open a further 400 stores worldwide this year. That’s on top of the 379 openings worldwide last year more than a store a day.

That’s despite the global rise of online shopping, with some analysts estimating a 20% rise worldwide last year, with consumers spending a recession-busting $1.5 TRILLION. For H&M, the future is bright.

While other stores may gather more column inches in fashion mags, it has got on with what it does best selling affordable, fast-fashion clothes.

The market leader worldwide is Inditex, owner of Zara. H&M falls not far behind. Last week it announced a 19% jump in net profits to £1.6 billion. When they do something, they do it right. A move into homes has been a success. H&M Beauty comes next.

Its main draw? Fashion that appeals right across the world.

“H&M’s core strength lies in providing cheap, fashionable clothing that translates across different cultures and geographies,” says Neil Saunders of retail research and consulting firm Conlumino.

“H&M has also done well on the marketing front with some strong campaigns, including ones with designer collaboration. This underlines the fashion credentials of the brand, which creates appeal with younger consumers.”

He’s right. When H&M announced a designer collaboration with celebrity shoemaker Jimmy Choo, shoppers in Glasgow and Edinburgh queued overnight to get their hands on some hot heels.

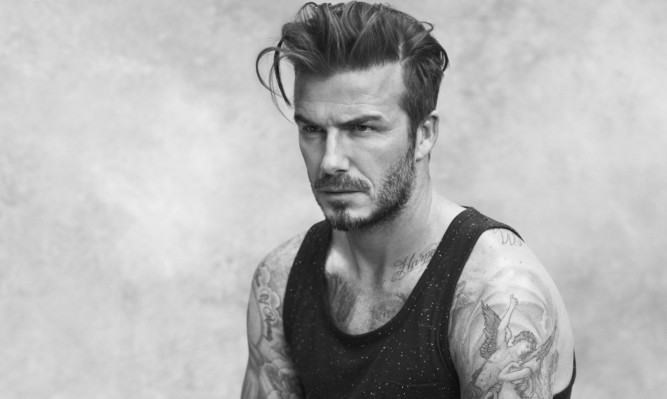

Likewise with designers Isabel Marant and Marni. And signing star names like David Beckham to launch fashion collections, hasn’t done any harm either.

If catwalk styles aren’t your thing, H&M’s big sister, COS, inspires a fanatical following, with style-conscious shoppers willing to snap up an everyday shirt for £79 and dresses for £115. Whatever your taste, whatever your style or budget, the H&M group have something for you.

Its fortunes are in contrast to struggling BHS, which faces an uncertain future. The fact Sir Philip Green is considering selling BHS comes as no surprise. It’s long been the problem child in his Arcadia family, which includes Topshop and Wallis, with losses of £21 million in 2014.

It’s not hard to work out where BHS has gone wrong.

Want the cheapest high street fashion? Go to Primark. Quality food? M&S is the brand of choice. Stylish home furnishings? Next is seen as the best bet. BHS just isn’t a destination store any more.

Neil Saunders says the fact BHS might be sold off could even spell the end of a once-great British brand.

“It is likely that the future will see some store closures and it is possible the chain could be broken up and disappear,” he says.

It isn’t that Arcadia hasn’t tried to put the zest back into BHS. Green recently tried introducing food halls into some stores. But look at Green’s store openings and closures in recent years and a clear strategy emerges. He’s opening more and more glamorous “sexy” stores like Topshop in out of town centres and cities. Add the fact it has £100 million in pension liabilities and it’s no surprise he’s looking to offload.

Like many other retail kings, it appears he believes “destination shopping” is the future of consumer spending and that regional high streets may figure less in his plans.

BHS could be a casualty of that.

From shabby to chic BHS and H&M, by Ali Kirker

If I hadn’t known which store was the winner in this tale of two retailers, I could have guessed when I walked through both on Friday.

BHS feels tired. That Christmas shop they set up every year? They’re still trying to flog off the remnants. No one wants cut-price Marmite chocolate or boxed Italian cookbooks, but they’re still there. Walking through womenswear feels like visiting the land that time forgot. Apart from Wallis and Dorothy Perkins concessions, it’s a mishmash of floral tops and badly-cut jeans last fashionable in 1978. The one bright spot, quite literally, is its lighting department. But how many of us buy a £320 chandelier every day?

On the other hand, H&M is a shopping joy. Its store is bright, fresh and modern. The high-fashion items its shoppers love are too tempting to refuse. £24.99 for a must-have jumpsuit? £7.49 for a jumper?

Don’t mind if I do.

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe