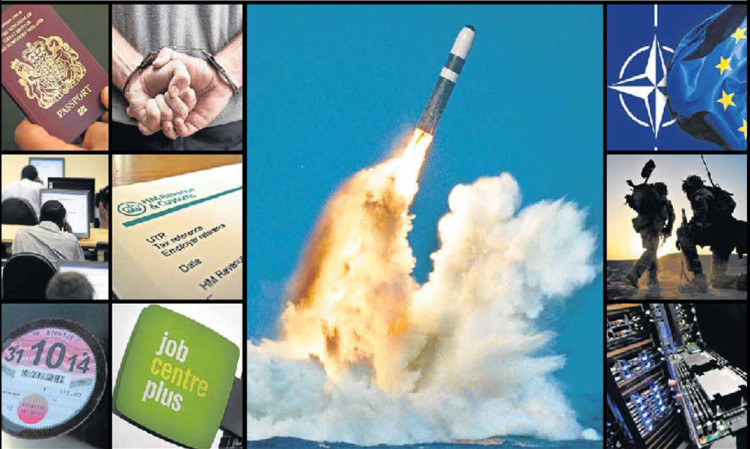

As Scotland considers independence, we summarise the many costs involved.

The Dunleavy Report was compiled following detailed discussions with Alex Salmond, Nicola Sturgeon and Scottish Government economists, as well as top officials in the Treasury. You can download the full report on the right hand side of this page, but here is a summary of the big issues tackled by Professor Dunleavy:

NEGOTIATIONS

ANY post-Yes negotiations will have a critical bearing on start-up and transition costs, according to Professor Dunleavy. His report points out that SNP ministers have assumed a “moderate and rationalist approach” from their Westminster counterparts, but the Coalition’s rhetoric to date does not bode well for this assumption.

“London ministers could take a hard line that apparently cares little or nothing for the future welfare of Scottish citizens (such as perhaps with their declared stance on monetary union),” warns Dunleavy, who claims such a move would at least speed up any split even though it would risk damaging the finances of what remains of the UK.

The report highlights Alex Salmond’s bargaining chips in what would be a “tough poker game”, highlighting the nuclear sub-marines on the Clyde as his trump card, with the First Minister having already issued an “infeasible deadline” of getting rid of Trident in the first term of an independent Scottish Parliament.

On Nato and EU membership, the report warns of “complex negotiations”, cautioning against Scottish Government assumptions these talks would be “easily or routinely assured”. Professor Dunleavy highlights that much hinges on the policy choices of the government elected in the 2016 Holyrood elections and makes the point that “most of the information needed to understand the transition costs lies not in Edinburgh, but in London”.

He concludes: “Perhaps the time is overdue for UK ministers to come clean on what exactly London’s stance would be if Scotland’s voters do decide to choose indep-endence.”

COSTS

THERE would be big costs beyond the initial £200 million needed for the 18 months before ‘independence day’ in March 2016. The Treasury has estimated new IT systems needed for administering taxes and welfare north of the border would cost £900m.

Professor Dunleavy claims this is not based “on any careful analysis”, but adds “given prevailing IT and change costs, they do not seem implausible”.

On the creation of new Security Services to replace the likes of MI5, the report highlights it could take up to five years of effective operation before an independent Scotland would be deemed reliable enough to join forces with the powerful Five Eyes alliance of intelligence operations which includes the UK and USA.

During the years of transition, the Scottish Government would have to pay a fee to use services such as the DVLA and welfare system until it could replace them with a Scottish version. Dunleavy points out this would see Scotland paying “the existing costs for these services, plus a small addition”.

The report also highlights the potential for “major initial problems” if many of the 700,000 people born in Scotland, but who now live in England, applied for Scottish citizenship with a fledgling Scottish Passport Office.

Another issue where there could be higher transaction costs is when it comes to pursuing Scots criminals who have fled to England and vice versa as time-consuming and costly European Arrest Warrants would be needed.

Another issue, hitherto undiscussed, is that what remains of the UK would also incur “disentangling costs” of demerging so many joint functions.

SAVINGS

THE Dunleavy Report claims bosses of any new Defence Directorate would have “perhaps the hardest tasks” given the work needed to create the force, but points out policy decisions, such as ditching Trident, could “quickly dwarf set-up costs” within a decade.

On the set-up of a newly independent Scottish Government, the report claims much of the UK Government’s structure of quangos and agencies is “highly elaborate and long-lived” and does not need replicated. Professor Dunleavy claims “significant initial streamlining savings” could be found by having no more than 136 Scottish public bodies, of which less than 60 would be new and of any significant size.

For example, the Electoral Commission has a UK-wide annual budget of £21m, but a Scotland-only version of the polling watch-dog could only cost £2m, claims the professor.

Interestingly, Dunleavy claims “tax morale” (the willingness of people and business to pay taxes) is “likely to rise” in the event of a Yes vote. The chance to move away from some of the complex and outdated IT systems used by the UK Government may also provide long-term savings, with the report saying: “There is good evidence that supplying government IT is generally cheaper and more effective in small states of around five to 10 million people, than it is at a UK-scale”.

The report also claims a John Swinney estimate that running a Scottish tax system would cost around £600m could be a mistake, pointing to the fact that Scotland’s population share of HMRC costs is currently only around £300m.

TRANSITION

EVEN if the “demanding” SNP timetable of concluding any post-Yes vote talks by March 2016 is met, there will still be some way to go.

The Dunleavy Report highlights that in areas such as defence planning, back office and procurement, and some taxes, “it will take a considerable time for Scotland to build up its own systems”. This means striking a deal to keep working with what remains of the UK and it is assumed this could take up to nine years. For instance, it is expected the registering of vehicles and licensing of drivers carried out by DVLA and three other UK agencies will continue to be based in Swansea until at least 2022.

One of the big arguments put forward by the Yes camp in favour of independence is control over taxes and welfare, but the report shows such levers might take years to fully transfer over to an independent Scotland. It is likely customer-facing areas such as call centres and websites would be set up fairly quickly, but “behind the scenes, for some years, the ‘back office’ systems for both tax systems and benefits would need to run through the existing, very complicated, computer and IT set-ups in the HMRC and DWP”.

Crucially, the report points out only when these systems are fully replaced with new Scottish ones would ministers in Edinburgh gain the “full freedom to vary benefits for Scottish citizens (planned for 2018) and personal taxes in Scotland (planned for 2020)”.

TIMELINE FOR TRANSITION

September 19, 2014

Work begins on creating the Scottish Security and Intelligence Agency, the Scottish Defence Force, defence policy capability, a foreign ministry and embassy network.

September 2014 to 2015

Work begins on creating a written Scottish Constitution as well as negotiations on the split of civil servants, assets and transition arrangements.

Early 2015

Scottish government reorganised into nine directorates.

March 24, 2016

Scotland becomes an independent country.

Scottish Security and Intelligence Agency takes over most responsibilities from rest of UK (rUK) counterparts.

Scottish Defence Force begins with initial set of forces and agreed co-financing of some rUK services. The Scottish

Defence Department capability is operating and growing.

Scottish foreign ministry comes into being, Foreign Service operating in around 50 countries initially.

May 5, 2016

The first election in an independent Scotland and the new government announces policies for tax and welfare, plus priorities for transition.

By end of 2018

Scottish Government assumes full control over welfare and benefits, including new IT systems.

April, 2020

Tax collecting body Revenue Scotland assumes full control of personal income tax system, including new IT systems.

Scottish Defence Force nearing permanent configuration. Defence directorate has full control (or a full role in joint NATO control) of all essential systems.

May, 2020

Second election to independent Scottish Parliament.

2022

Scottish Motor Services Agency takes over DVLA and other UK motor related regulatory functions.

2020-2022

Remaining tax functions and IT systems now fully controlled by Revenue Scotland.

Source: The Dunleavy Report

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe