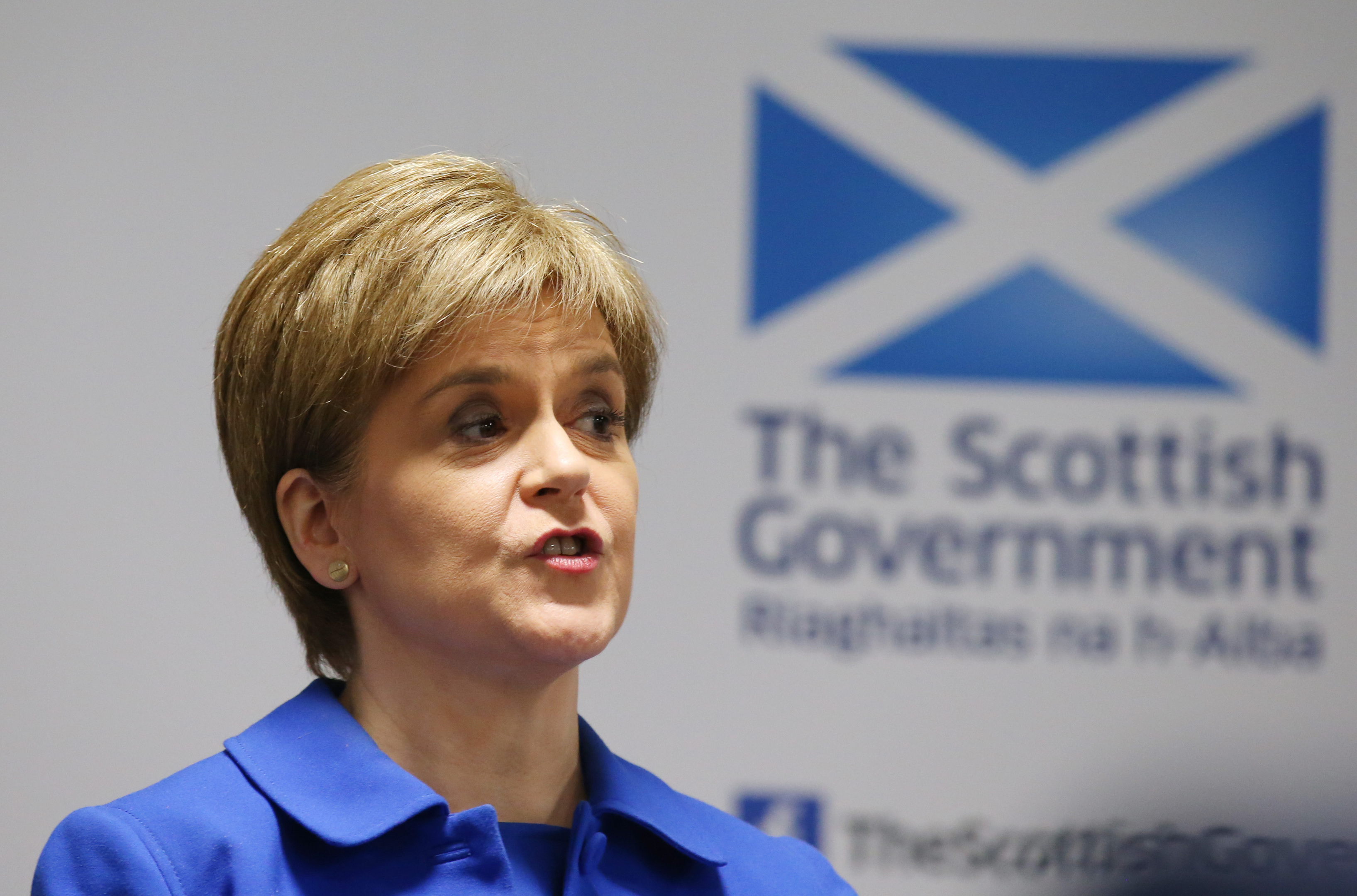

Nicola Sturgeon revealed higher charges are to be brought in for those living in properties from Band E through to Band H – a move which will bring in extra cash of £100 million a year for schools.

In addition the council tax freeze, which has been in place since 2007, is to be ended from April next year.

From that point councils will be able to increase the charge by a maximum of 3% a year, potentially allowing authorities to raise up to £70 million to help fund local services across Scotland.

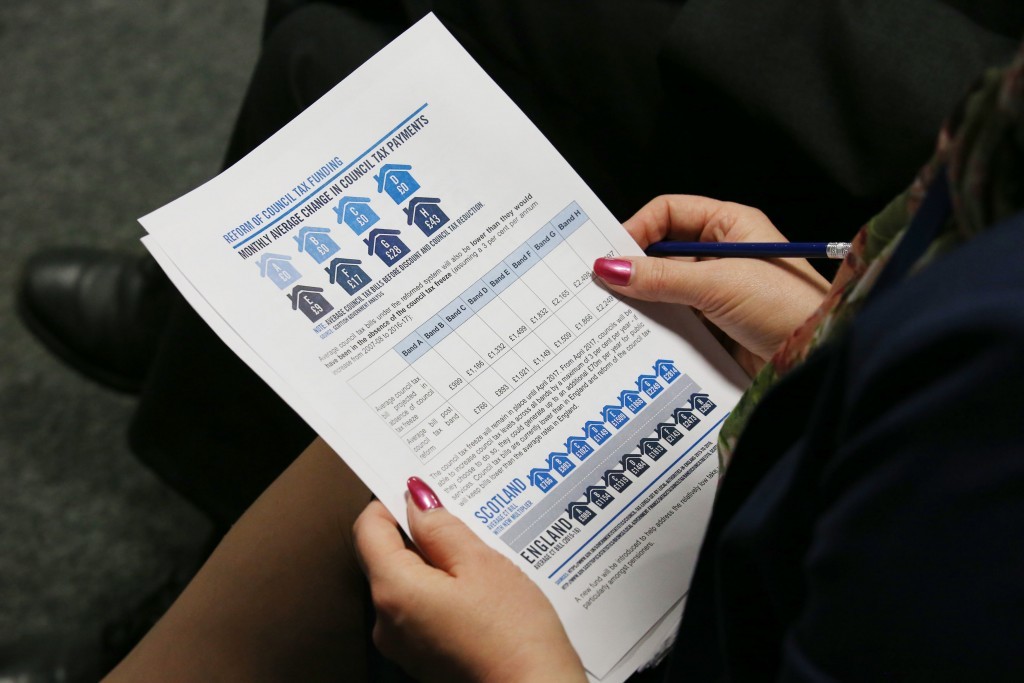

From April next year the amount that residents in homes rated from Bands E to H pay in comparison to an average Band D property will be increased.

The council tax bill for a Band H property is currently twice that charged on a Band D home, and this is to be increased so it is 2.45 times the Band D payment.

The Scottish Government estimates this change could cost these families about £10 a week – or more than £500 a year.

But ministers stress three quarters of families who live in homes which are in Band D or below would not be affected by the change to the band system.

In addition some 54,000 low income households who are living in Band E to H homes will be entitled to an exemption through the council tax reduction scheme.

Increased stamp duty, higher income and council taxes on way – influence of the middle class vote in Scotland is very different to England!

— Andrew Picken (@andrewpicken1) March 2, 2016

This table gives an idea of the big variances in the number of top council tax band properties in each area. pic.twitter.com/4u5DqdVqcj

— Andrew Picken (@andrewpicken1) March 2, 2016

Ms Sturgeon said: “These reforms to council tax bands will mean no change for three out of every four Scottish households, with those in lower banded properties paying no more than they do now.

“Households will also still, on average, pay less than those on equivalent bands in England and less than they would be paying had the council tax freeze not been in place.”

She added: “To support those on low incomes and provide additional support to families we will also increase the child allowance within the council tax reduction scheme by 25% – this will benefit

77,000 households by an average of £173 per year – around £15 per month. This boost for low income families will help nearly 140,000 children across Scotland.

“We will also extend the council tax reduction scheme to exempt 54,000 households on low net incomes, but who live in higher property bands, from the change to the system.”

The change was announced after a report by the cross-party Commission on Local Tax Reform last year called for an end to the council tax and urged politicians to implement a fairer, more progressive and transparent tax to fund local services.

Ms Sturgeon said: “The Commission on Local Tax Reform made clear that the present system could be made fairer. We are choosing to do this in a reasonable and balanced way that will also generate £100 million of additional revenue to invest in schools.”

The changes to council tax rates for those in more expensive homes will cost households in Band H properties an average of £517 a year, the Scottish Government estimated.

Those living in Band G properties will see payments increase by an average of £335, with rises of £207 a year for those in Band F homes, and £105 for Band E properties.

As well as making changes to the council tax system, the First Minister confirmed the Government will consult with councils on the possibility of swapping a fixed share of their grant for a proportion of funds raised by income tax.

The change would mean councils would benefit directly from economic growth, with ministers arguing it could serve as an incentive to local government.

The consultation will take place after May, if the SNP is re-elected to power at Holyrood.

Ms Sturgeon, who announced the changes at Lasswade High School in Bonnyrigg, Midlothian, said her Government had “heard demands for local authorities to be more responsible for their own finances and be less dependent on grants from central government, but without adding to the burden on households”.

She said: “As part of our proposals, from April 2017, we will replace the council tax freeze with discretion for councils to increase tax – if they so choose – by a maximum of 3% a year. This will see councils be more accountable for raising revenue, while ensuring that the rapid and significant rises we saw in the past do not return.

“Importantly, to ensure the contribution individuals make to the delivery of local services is more closely tied to their earnings, as well as to incentivise councils to support economic growth, we will formally consult local government on the assignment of a portion of the devolved income tax raised in Scotland to councils, reducing their reliance on grant funding from central government.

“Overall, these proposals will protect household incomes, support investment in our schools, make local taxation fairer and ensure local authorities continue to be properly funded while becoming more accountable.”

In a Q&A session after making the announcement, Ms Sturgeon was pressed toexplain why she had not been “bolder” and opted for total reform includingfull council tax revaluation rather than “tinkering” with the system.

She said: “What I’m setting out today – short, medium to long term – is a substantial change to how councils are funded and I think that is right.

“Tax policy should not be seen as some kind of political virility symbol. We need to make sure that we have tax changes that are fair, reasonable, measured and introduced for a purpose. That is what I’m setting out today.

“I’m asking people in the most expensive houses in the country, those in the top band, will pay a significantly increased portion in council tax and also taking steps to make sure those on the lowest incomes with children will pay less in council tax, paving the way then for a more substantial reform in terms of what we’ve said around income tax.

“I think this is the right way forward, I think it’s fair and it’s balanced and I think it will meet with approval of people around the country.”

The First Minister confirmed there are no plans for a revaluation of the council tax, which remains based on 1991 property values.

She said: “The commission made very clear that if we were to do a revaluation there would be changes to the amount paid by the majority of people across Scotland, some of those would be very significant and dramatic changes and my judgement is that that’s not the right thing to do at this stage.”

Ms Sturgeon added: “We are in a situation where for many households things are still tough and tight and I don’t believe that a change like that, which would deliver substantial increases for many people who would not be able to afford them, is the right way forward.

“Instead, I’m setting out a balanced, reasonable and measured approach.”

Ms Sturgeon dismissed concerns that the reforms, when combined with the stamp duty replacement LBTT, would make Scotland a less attractive place for the better off.

“Even applying these changes, council tax across all bands on average in Scotland remains lower than it is in England,” she said.

Asked whether the reforms could signal what is to come when the SNP sets out its plans for income tax, she said: “You shouldn’t necessarily read anything into that from this, except that we will continue to take a fair and a progressive approach to all of what we do.

“I’m very mindful in everything we do or will do around taxes of the impact on people who are struggling to make ends meet, and that’s why I don’t support the position put forward by Labour to raise the basic rate of income tax because it hits low-income earners and those in the middle.”

READ MORE

SNP set to drop opposition to scrapping Sunday shopping laws in England

SNP MP says austerity will increase appetite for second independence referendum

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe