ELDERLY and vulnerable people are being urged to check the small print – after it emerged an unscrupulous loan broker was charging hidden sky-high fees.

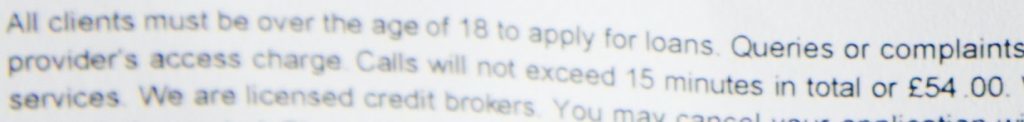

Buried in a hard-to-spot footnote of its mail shot, Glasgow-based Bright Sky Loans reveals you will be charged £54 if you make a 15-minute call to arrange a loan.

And, incredibly, hitting people with such a large hidden charge isn’t even illegal.

The practice has prompted fresh warnings from experts who say such scams suck in thousands of elderly and vulnerable people every year.

David Hickson, of the Fair Telecoms Campaign, said: “This might not be a breach of the law but we are certainly in scam territory here.

“Making charges like this is wicked and moral exploitation. I’d urge anyone calling premium rate numbers to look closely at what they are being charged for.”

The call was echoed by Citizens Advice Scotland which said consumers should be “vigilant”.

Bright Sky Loans is run by controversial businessman David Drysdale, despite the fact he was slapped with a trading ban three months ago.

The company is currently bombarding homes with flyers offering short-term, unsecured loans with a typical APR of around 16%.

The highly-attractive rate is aimed at the most vulnerable in society – pensioners, the unemployed, broke students and single parents. Some loan firms offer four-figure interest rates.

But, hidden in the small print, is the £54 phone call charge.

Ferrari-driving Drysdale, 33, who lists his address as with his mum in Whithorn village, near Newton Stewart, Dumfries and Galloway, was ordered to stop trading by an industry watchdog back in April.

But a Sunday Post probe can reveal his Bright Sky Loans is still targeting people with its outrageously expensive service.

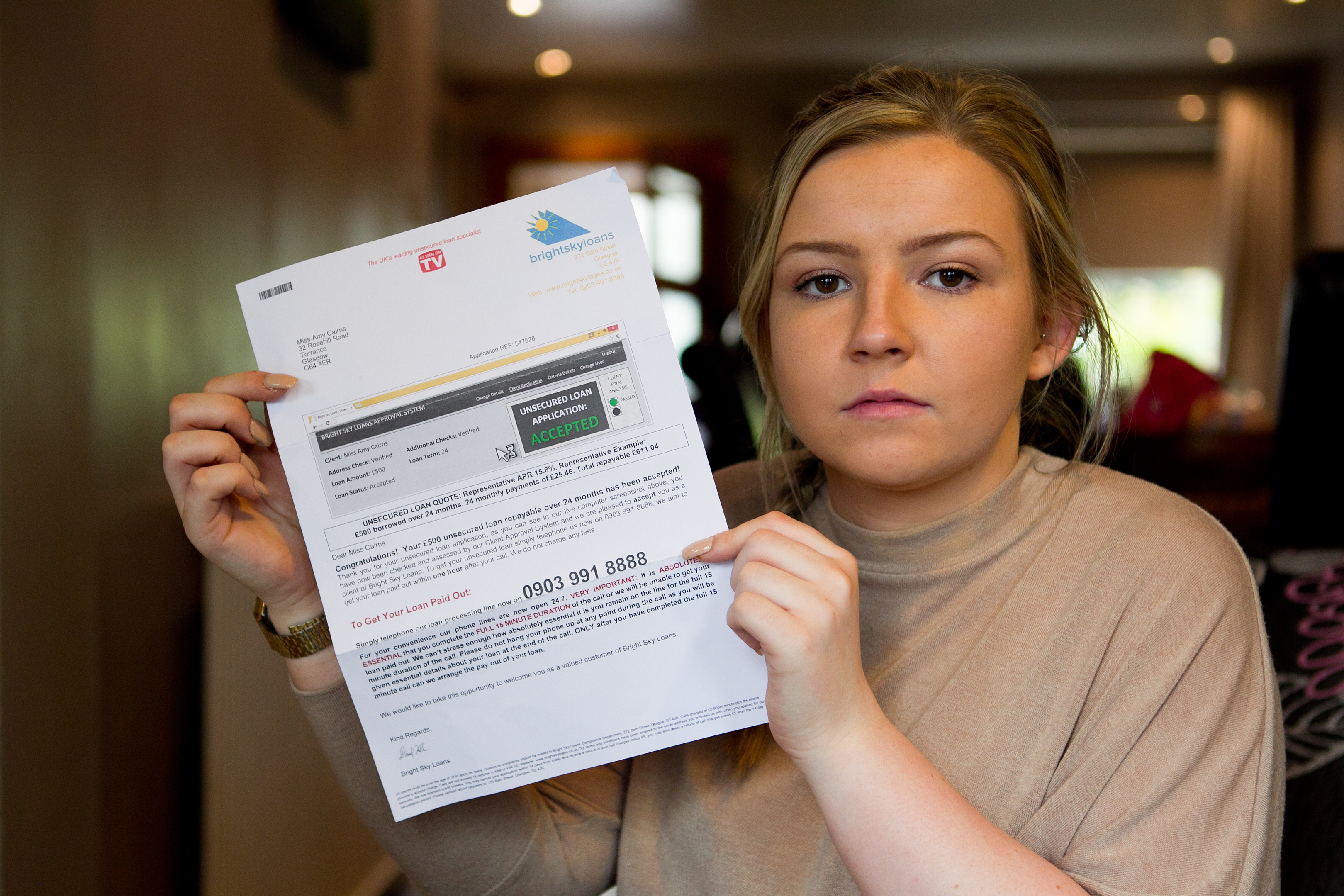

Amy Cairns, 19, a health and social care student at Springburn College in Glasgow, has recently received three letters offering her a loan via Bright Sky.

She has no idea how the company got her details and said: “I’ve never applied for a loan before but I was on the verge of calling to arrange one before my parents said it looked like a scam.

“I can’t believe it would have cost me £54 for a single call.

“I’m worried about how they got my details.”

Bright Sky – set up in 2014 – makes its money from the exorbitant charge it hides in its mailshot bumph.

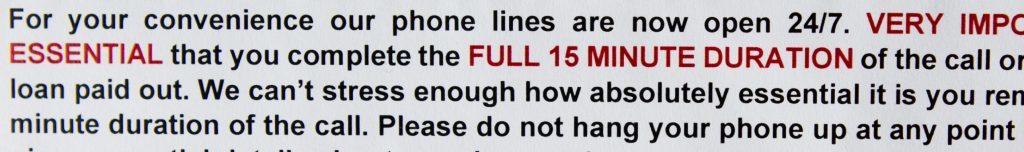

Individually-tailored letters sent to potential customers say “it is absolutely essential” they “complete the full 15-minute duration of the call” to successfully qualify for a loan.

But what they don’t realise is the small print details that the call is charged at £3.60 a minute plus the phone provider’s charge.

Understandably, Bright Sky Loans, and the way it operates, has prompted a flood of customer complaints.

Key among them is claims it has failed to arrange or pass on details regarding the promised loans it says it brokers.

As such, three months ago, watchdog body the Financial Services Authority banned Drysdale and Bright Sky Loans from trading.

It ruled the firm should stop entering new applications with customers and cease to use any premium rate service telephone subscription with immediate effect.

But, as in the case of Amy Cairns, the company is still sending out letters touting for business and claiming to be a “licensed credit broker”.

Last week, a simple call revealed its premium rate number was still active.

A Sunday Post reporter called it and was met with a pre-recorded message offering to arrange a loan.

As a result of the apparent breach, Drysdale could now face further sanctions including a fine and possible criminal proceedings for continuing to operate despite being banned.

In the last month, Bright Sky Loan customers have taken to a new online consumer forum called A Spokesman Said to voice their anger at the firm.

The customers, including pensioners, have complained about the company charging for calls but not paying out on promised loans.

And summing up the firm, the website – run by former newspaper editor Kelvin McKenzie – says: “Some companies act in a way that makes us wonder how their bosses sleep at night.

“Glasgow-based Bright Sky Loans is such a company.

“It laughably describes itself as ‘one of the leading finance companies in the UK’.

“We can’t say this loud enough – avoid this company!”

Drysdale is listed as a broker with Bright Sky Loans despite being banned from running any companies until 2024.

He side-stepped the pitfall by resigning as Bright Sky’s director in 2014.

A UK Government-led probe into Drysdale last year found he paid himself £10,000 a week while running another company called Welcome Loans.

It was alleged Drysdale used clients’ cash to buy himself a £200,000 Ferrari 458 and a £180,000 Lamborghini Gallardo.

The investigation was launched by the Government’s Insolvency Service after Welcome Loans went bust in 2013 leaving a string of angry customers in its wake.

Instead of charging customers for calls, Welcome Loans charged them a £70 set-up fee.

But customers – many pensioners or single parents – found they were being charged for loans that were never agreed.

In some cases, the set-up fees were deducted multiple times from their accounts without their knowledge and with no refunds.

The Financial Ombudsman received 233 complaints about Welcome Loans.

Officials later discovered Drysdale had opened a secret offshore bank account in the tax haven of Mauritius with £270,000 in it.

He moved £121,000 into the same account shortly before Welcome Loans went bust – money which should have gone to the creditors.

It’s claimed Drysdale lavished cash on his one true love – fast cars.

There was no sign of a flash motor when The Sunday Post called at the home he shares with mum Martha, 59, in quiet Whithorn last week.

A woman, believed to be his mum, answered the door and said: “He’s not in. I don’t know when he’ll be back. He’ll not speak with you.”

Where is Bright Sky Loans based?

DESPITE claiming to be the “UK’s leading unsecured loan specialist”, tracking down Bright Sky Loans is anything but easy.

Its office in Bath Street, Glasgow, is a virtual office, homing thousands of other businesses operating remotely.

According to records lodged with Companies House, Bright Sky Loans is registered to Drysdale’s mum’s house in Whithorn, Dumfries and Galloway.

Our investigation also found its website – brightskyloans.co.uk – is registered to the same property, owned by Martha Drysdale, since 2003.

The Financial Services Authority lists Drysdale as a broker at Bright Sky Loans.

However, official records reveal he resigned as a director five months after setting the firm up in 2014.

The only current director listed is Helena Steskens, 33, from Salford near Manchester.

We tried to contact her last week but she did not return our calls.

Bright Sky Loans’ accounts show the company made just over £19,500 last year.

Tycoon’s £200k crash

HIS companies aren’t the only thing Drysdale has steered into trouble.

In 2013, the fast-car loving company executive wrecked a Ferrari just weeks after buying it.

Then 29, the tycoon crashed the £200,000 red Ferrari 458 in Dumfries on his way to see his mum.

At the time he said: “I heard a bang, the steering locked and I went off the road. I’m gutted.”

But that’s not the only supercar he has owned.

Government investigators looking into his previous company, Welcome Loans, said he spent £97,000 of the company’s cash on a Bentley for his own use.

It was also alleged he used clients’ cash to buy a £180,000 Lamborghini Gallardo sports car.

READ MORE

Citizens Advice warn of scam victims losing £20,000 on average to frauds

5.6 million people are victims of online scams each year in Britain

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe