FRAUD gangs are targeting parts of Scotland they previously could not reach in a new wave of organised crime, according to new reports.

Bank and credit card fraud has climbed dramatically around the country’s coastal areas and islands as criminals target victims by phone and email.

The latest police figures show a rise in fraud from Shetland to the Borders, with cases more than doubling in some areas.

Police yesterday said austerity has contributed to the rise, warning the economic climate is “ripe for fraud”.

But the rise of internet banking, online shopping and the roll-out of broadband to rural areas has also given criminal gangs access to people living there for the first time.

Gareth Shaw, money expert at consumer organisation Which? said: “Nowhere in the country is out of reach of criminals using increasingly sophisticated techniques to scam their victims.

“In the digital age, people are falling victim and losing life-changing sums of money to scams on their computers, phones and other devices.”

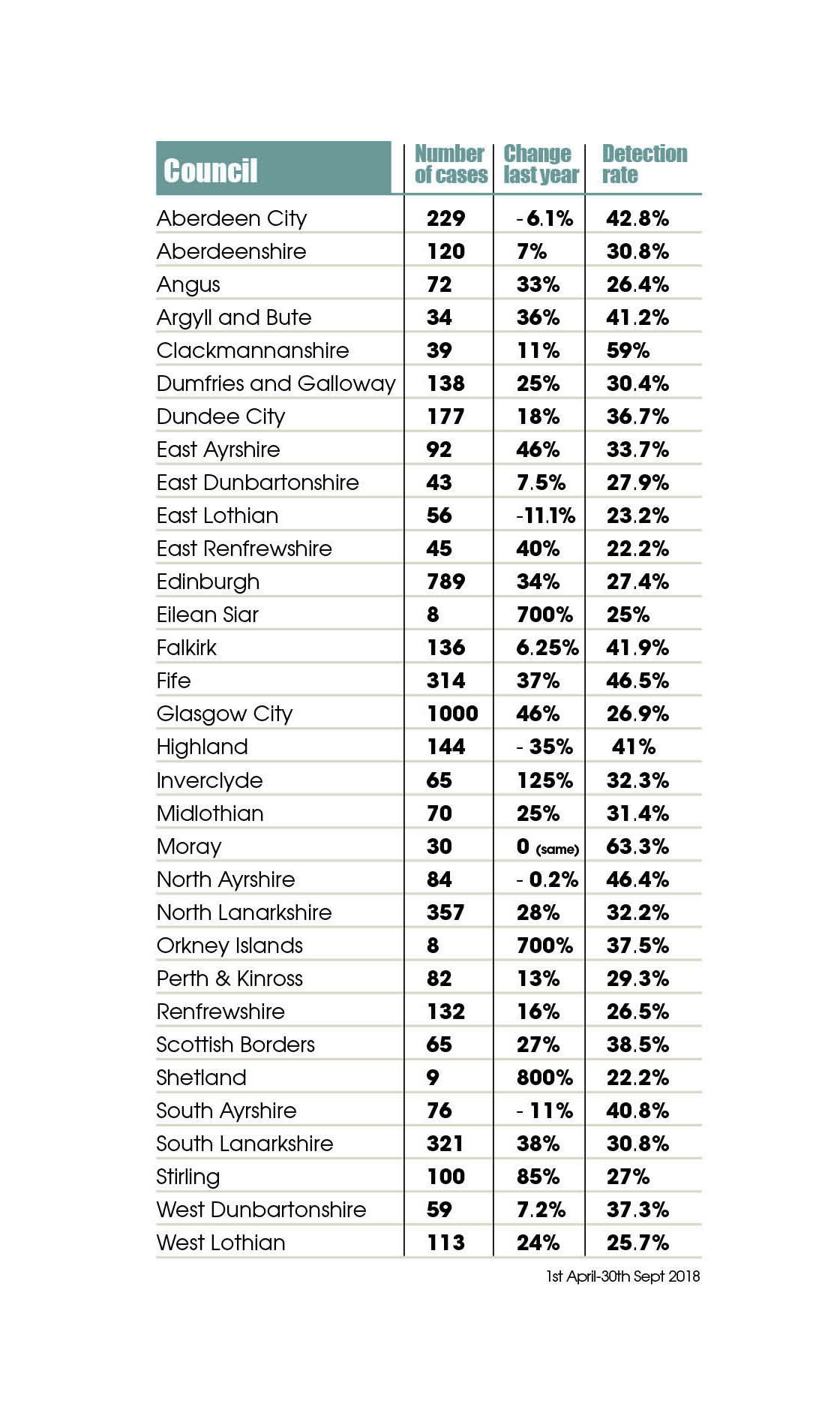

Police Scotland figures show fraud rising in areas where it was previously low or almost unknown.

While the total number is low in line with smaller populations, the percentage rise in fraud across Scotland’s islands reached more than 700%, year on year.

Orkney, Shetland and the Western Isles recorded just one case each of fraud between April and September last year.

But this year there were eight cases in both the Western Isles and Orkney, while Shetland recorded nine in total.

Police in Orkney say money lost to fraud on the island in the first 10 months of this year reached £350,000.

In Inverclyde, 65 cases of fraud were recorded – a rise of 124% compared to the same time last year.

In the Borders, Dumfries and Galloway and Argyll and Bute cases increased by more than 25%.

Only five council areas out of 32 – Aberdeen City, East Lothian, Highland, North Ayrshire and South Ayrshire – saw a drop in fraud cases, while Moray had the same number as last year at 30.

Across Scotland fraud cases increased by almost a quarter year-on-year, with a total of 5,007 crimes.

Detective Inspector Gordon Burns, of Police Scotland’s economic crime and financial investigations unit, said a number of factors had contributed to the increase.

“These include austerity in the last few years,” he said. “I think the economic climate is ripe for fraud.

“There are also many aspects of fraud that have become more sophisticated.

“It’s much easier to commit fraud because you can use the internet and phones.”

He added: “The tried and tested methods of the con man appearing at the door are still there and still evident.

“But over the years fraud has become much more sophisticated and that has led to £193 billion being lost to the economy last year.”

The fastest rising method is vishing, where scammers con people into parting with money or obtain key information such as website passwords using the phone.

Criminals see such scams as relatively low risk with only around one in three fraud cases being cleared up by police.

Mr Shaw described the clear-up rate as “shocking”, saying: “The shockingly low success rate for fraud investigations is leaving many victims deprived of justice and suggests the authorities are fighting a losing battle against this type of crime.”

Computer security expert Ian Thornton-Trump, head of cyber security at insurers AmTrust International, said scams were often targeted at isolated or elderly people with the help of the “prolific trade” in personal information that cyber criminals can use.

Mr Thornton-Trump said: “One of the reasons you see it starting to move into the more rural areas is, of course, internet connectivity.

“Those communities have probably not had a lot of experiences with the more professional cyber crime outfits that have had a great deal of success.

“The phone has become the preferred attack surface because of the fact elderly folks may not be computer literate or be distrustful of the computer, but they have far more comfort on the phone and talking to people.

“It is a real clarion call for the fact you need to be aware and you need to be cyber-literate.”

Mr Thornton-Trump said vishing was an “entry level” type of cyber crime as all that was needed was a phone and a few of the target’s personal details.

He added: “That will vary, up to the really sophisticated operations running call centres.

“They will literally recruit folks who have similar sounding accents to create a bit of familiarity to target victims and they will have personal details – date of birth, last four digits on a credit card – to ‘verify your account’.

“In a lot cases it is a multi-step fraud where perhaps a weblink is provided to the person to open up on their phone, and that website has links to a malicious site to harvest login IDs.

“What starts with a phone call can end up emptying multiple bank accounts as well as, potentially, online applications that the individual has on their phone – such as eBay, PayPal, banking and Amazon.”

He added: “If you don’t know the number on your phone, don’t answer the call.”

Across the country, around one in three fraud cases – 32.5% – were successfully cleared up by police, according to the latest figures.

However, there is huge variation between local authority areas – ranging from just over 20% in East Renfrewshire and Shetland to 63% in Moray.

Detective Inspector Burns added: “We are working towards better outcomes and it’s fair to say that nobody is going to be happy at a one-in-three clear-up rate.

“We are aware of what needs to be done and we are working towards that by ensuring that we not only train our staff but we put a wider message out to the public.”

He said there was an “element of common sense” that had to be asked of people when it comes to avoiding being duped out of money by criminals.

He warned: “If it’s too good to be true then think about it.

“If people take five or 10 seconds to consider what they’re doing and how they’re transferring money and who they’re transferring money to – that would help.

“Be vigilant and consider what you’re doing.”

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe