Financial measures brought in to deal with the lockdown are protecting landlords and banks more than families, according to a new report.

The Government’s response to the coronavirus crisis will widen inequality across the UK, a study by the Institute for Public Policy Research (IPPR) claimed.

The Covid-19 response has “left (the) poorest to shoulder most economic risk”, the think tank said.

The report found that 45% of the cost of the work furlough scheme in response to the coronvirus outbreak will be spent on rent and debt repayments.

The IPPR said this amounted to “an implicit bail-out of landlords and banks”.

The money would amount to £10 billion under a three-month shutdown and £21 billion if the lockdown continued for six months, the report said.

The furlough scheme sees people paid 80% of their wages up to a maximum of £2,500 a month.

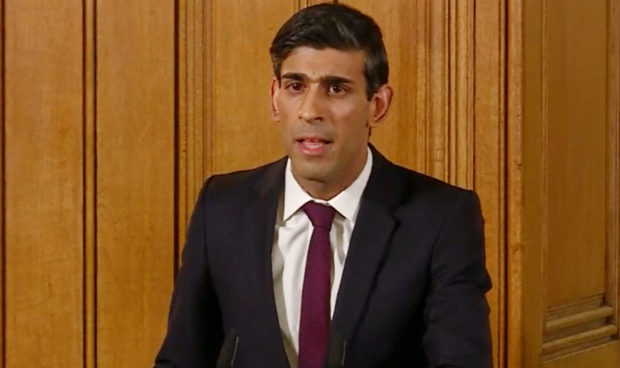

Chancellor of the Exchequer Rishi Sunak announced on Tuesday he was extending the jobs furlough initiative to October and that changes would be brought in with employers having to share some of the cost from August.

The IPPR study said families in upper pay brackets who are still able to work are likely to be spending less and saving more while low-income families on furlough will be gradually and increasing debt.

When incomes are split into brackets for each 10% of the population, households in the second highest earning group may be saving an extra £189 per week on average, where earners are able to continue working from home.

However, those in the second lowest income bracket may be adding an average £12 a week to their existing debts, if earners are furloughed on 80% of salary.

“Better-off households will make significant savings from curtailed ‘discretionary’ spending on holidays, hotels, restaurants and cultural and leisure activities, but as poorer household spend less on these they have little scope to make such savings,” the IPPR said.

“The long-term effects of rising indebtedness on the one hand, and a likely rebound in asset prices on the other, are likely to further widen inequalities between the working poor and the asset-owning wealthy.

“Without steps to actively redress these inequalities and to ensure the risks of the crisis are fairly shared, the UK’s economic recovery is likely to be slow, uneven and unfair, worsening existing structural imbalances.”

Among the measures called for by the think tank are to “explore the possibility of a freeze on rent, debts and bills for some struggling households, without new debts accruing, within current legal frameworks”.

The think tank’s executive director Carys Roberts said: “IPPR’s research finds that while millions of people across the country are seeing a hit to their incomes, the government is under-writing the income of banks and landlords without any obligation to take a similar hit. That amounts to an implicit bailout.

“The Government must urgently ensure that its programme of support is protecting those who need it. And as we emerge from this crisis, it will be critically important to rebuild a fairer economy, with those whose incomes have been protected contributing more.”

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe