“If the independence debate is a battle between head and heart it’s worth pointing out business has no heart.”

Business dislikes uncertainty and no one can dispute that a Yes vote in September would trigger much uncertainty, not least over issues that could have a big economic impact like the currency and the EU.

Similarly, business doesn’t like borders and, no matter how invisible it may be in practice, independence would erect a border between Scotland and the rest of the UK.

So the SNP know they have their work cut out convincing the business community that independence would be good for them. But convince some they have.

The campaign group Business for Scotland claims to have more than 2000 individual members. In fairness the CBI, which is firmly against independence, is 20,000-strong, though it’s unlikely every one of those companies supports its stance.

Those favouring a Yes vote have been attracted by a suite of policies set out in the independence White Paper designed to woo wealth.

The most eye-catching is a promise to cut corporation tax by three percentage points.

The SNP hope that low corporation tax rates will attract more firms to Scotland, and boost the productivity of those already here since they would have more money to invest.

Certainly the Scottish Government has proved adept at attracting foreign investment Scotland runs only behind London in terms of cash injected from abroad. But it’s struggled to foster homegrown entrepreneurs.

There’s a theory that entrepreneurship has been stunted in Scotland by the expansion of the public sector in recent decades. Government makes up the biggest chunk of the onshore economy.

And the figures show only around half as many start-up companies per person are established in Scotland as in countries like Canada and the USA, and the start-up rate is well behind the UK as a whole.

Research by The Tom Hunter Centre for Entrepreneurship at the University of Strathclyde found thousands of ambitious Scots moved to England to start their business ventures.

Those that make it ultimately look to export, and the White Paper says the SNP would look to boost exports. That goes without saying as everything currently sold into the rest of the UK would suddenly be classed an export.

It’s claimed Scotland would export more by value to Worcestershire than it does to China. Currently those goods going to England are traded with no tariffs or barriers of any kind within the common market that is the UK.

The SNP also promise streamlined regulation. That seems sensible but they don’t explain how they’d achieve it.

The Coalition claimed they’d cut red tape but they are finding that lots of rules and regulations actually have a purpose. Some red tape business doesn’t want to lose.

Scotch whisky has been a huge success in recent years but the Scotch Whisky Association is not keen on independence.

That’s not least because, were Scotland to fall out of the EU and despite the intervention of new president Jean Claude Juncker last week it’s still not clear how or when an independent Scotland would get into the club it would lose its protected status.

Massive markets like India and China would quickly discriminate against it, in favour of homegrown products, through their tax systems.

And, even if Scotland did have a rational regime of regulation, any business looking at where to locate would have to weigh up what was more attractive Scotland’s streamlined oversight or the remaining UK’s 55 million consumers, 10 times that of Scotland.

And that’s the rub for an independent Scotland.

The White Paper offers all sorts of sweeties to business along with vague promises to “boost and diversify” the economy and encourage more manufacturing and innovation.

But businesses exist to make money and, since there are more people in England, that’s where many of them will want to go.

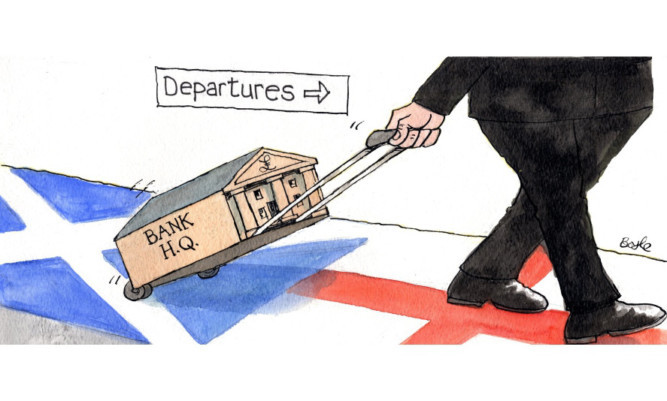

A survey earlier this year found around one-third of companies would consider relocating in the event of independence. Already, Edinburgh-based finance firms are setting up so-called shell companies registered in England.

If there’s a Yes vote they just switch their head office over the border and it is, quite literally, business as usual. That has led to warnings of employment Armageddon in Edinburgh.

Finance accounts for a quarter of the onshore economy in Scotland. Its size in relation to the rest of the economy is disproportionate.

The banking sector is more than 12 times the size of Scotland’s GDP much higher than nations like Iceland and Cyprus who were left horribly exposed by the banking crisis. In the UK, financial services are around five times GDP.

Given most of their business is in England, the giant financial firms such as Standard Life, Alliance Trust Savings and maybe even the Bank of Scotland and RBS still registered in Edinburgh but effectively headquartered in Whitehall while they remain taxpayer owned might not just want to move.

They may in fact be required to by EU rules that insist financial products cannot be administered by overseas firms and that’s what Scottish institutions would become.

Bank of England governor Mark Carney said there was a “distinct possibility” RBS would have to move when he appeared before MPs earlier this year.

On the other side, the bank’s chief executive said it could “adapt” to independence while the boss of Barclays said his organisation could “make it work” when asked about the prospect of separation.

With conflicting comments, perhaps history offers an idea of what might happen.

Montreal was a financial powerhouse until Quebec started seriously trying to split from the rest of Canada in the 1970s. At that point many banks and financial institutions started switching to the more secure surroundings of Toronto.

The counter-argument goes that, with independence, Scotland can still be close to the global hub that is London, but Edinburgh would have the powers to make Scotland compete more keenly but mitigate the downside of being so close to London.

Even UK business minister Vince Cable admitted the capital was a “dark star” which sucked up resources from the rest of the UK.

There’s a weird graphic in the business section of the White Paper that lists Scottish successes such as inventing the telephone and the television. It includes the words Peter Pan and Sherlock Holmes.

Both had Scottish authors but royalties from the former still go to Great Ormond Street Hospital in London, while the latter’s fictional home was 221B Baker Street in the same city.

The graphic only serves to highlight the links between Scotland and the giant business hub of London.

When deciding whether to back independence or not, many firms will consider it elementary to back certainty and the status quo over the more romantic notions coming from the nationalists.

For if the independence debate is a battle between head and heart it’s worth pointing out business has no heart. Companies exist to make money and to that end they like as few barriers as possible.

Some firms might not like Westminster policies but they like being in a common UK market with a single currency and a common regulatory regime.

The SNP proposals for business post-independence are not without merit but, while Scotland can be separate politically from the rest of the UK, it can’t be sealed off economically.

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe